Which regions are most exposed to the 25% automotive tariffs?

The US is set to impose new tariffs beginning April 2, adding an additional 25% on all imports of passenger vehicles, light trucks and certain automotive parts. While there is sufficient spare capacity to accommodate some near-term reshoring to existing US facilities, this would come at the expense of reduced competition, higher prices, and significantly lower production in the US’s main trading partners.

What you will learn:

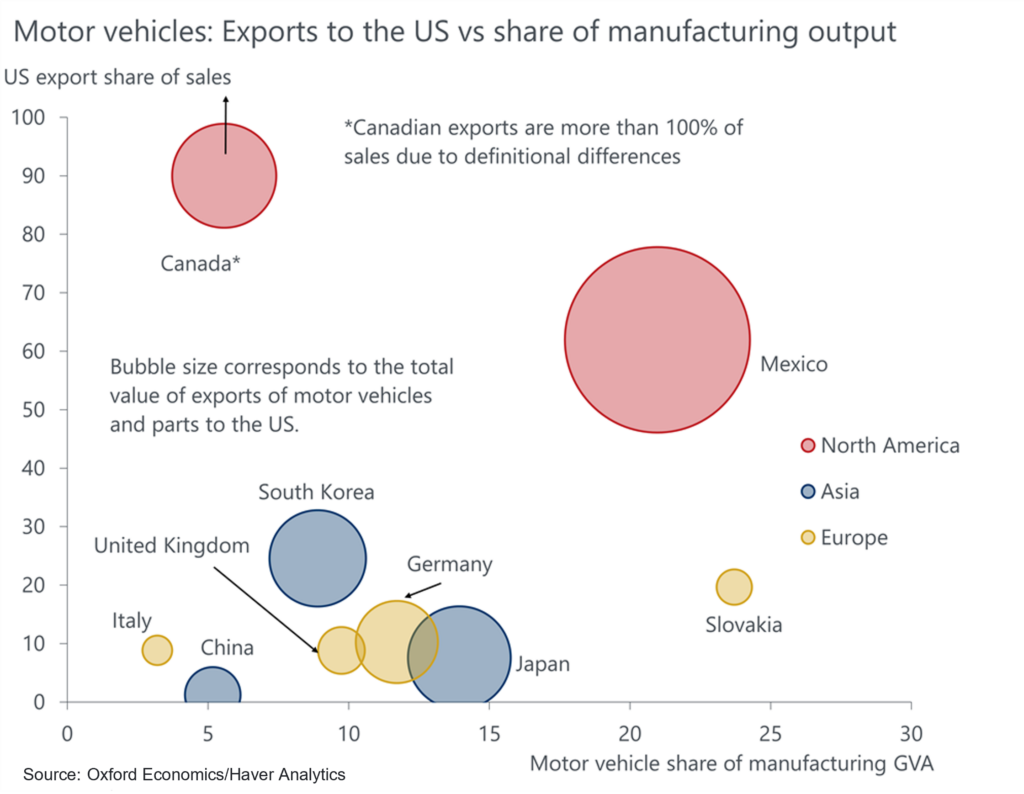

- Tariff disruption will be felt most across the Mexican border states, while Ontario bears the brunt in Canada. Both Canada and Mexico export a large share of total automotive sales to the US, and automotive parts also cross borders several times before final assembly.

- Outside of North America, Japan and South Korea are the largest automotive exporters to the US. Anecdotally, Japanese car companies are preparing to ramp up production at their existing US plants, suggesting that even the threat of tariffs will likely curtail production in Japan.

- While the direct export exposure to the US is smaller in Europe than elsewhere, motor vehicles are an important manufacturing sector in several countries, especially in CEE economies such as Slovakia and the Czech Republic.

- While the tariffs will likely have the effect of reshoring some automotive production to US plants, it will also raise the cost to US manufacturers and households. Our analysis suggests that the tariff applies to nearly one third of the price of the car.

Tags:

Related Reports

Why the new tariff deals aren’t a growth game changer

GDP growth likely to be revised up but will remain weaker than assumed prior to Liberation Day.

Find Out More

Identifying future manufacturing hot spots in Japan

Japan's industries, which are exposed more to international demand than to tepid domestic demand, are often concentrated in certain cities. This makes these cities more dynamic than others, a feature masked when only looking at national data. Understanding the industrial landscape helps identify growth opportunities across various sectors, as job creation and incomes drive spending.

Find Out More

The US-China tariff deal signifies a major de-escalation

The latest US-China tariff deal suggests less of a drag on the economy through the rest of this year.

Find Out More

Oxford Economics Launches TradePrism on Snowflake Marketplace to Deliver Global Trade Intelligence in Near Real-Time

Oxford Economics, a global leader in economic forecasting and data analytics, has announced the launch of its TradePrism platform on Snowflake Marketplace, enabling businesses to seamlessly access and integrate trade data and forecasts into their operations in near real-time.

Find Out More